|

|

|

|

Estimated Reading Time: 2 Minutes |

|

Hello {{CFirstName}}, |

|

Week 4 of the 2024 Legislative Session has concluded. It is hard to believe it's already been a month since the start of the session. This week a few important things happened. HB415, the "Guns in Schools Bill" was debated on and passed the House floor. A new bill was introduced on Tuesday, that would allow parents to receive refundable tax credits for their children's private school tuition and other expenses. HJR001, which would repeal Article 5, Section IX of the Idaho Constitution (also known as the No-Aid or Blaine Amendment), was also held in committee after lively testimony, including the Satanic Temple testifying in favor of the bill.

We also saw a few bills introduced in House Education focused on IDLA, the State Board of Education's regions, school district activity funds, reading assessment exemptions, and an advanced opportunity scholarship. Representative Healey also introduced a bill in House Health and Welfare that would add additional requirements to immunization notifications in schools. |

|

School Voucher/ESAs/Tax Credit Legislation Updates |

|

Tax Credit Bill

HB447, was introduced in House Revenue and Taxation on Tuesday. This legislation would create a refundable tax credit of $5,000 per child - $7,500 if the student has a disability – for expenses including private school tuition, assessments, tutoring, AP tests, textbooks, curriculum, transportation, and “other educational materials” used for K-12 academic instruction. It’s a $40 million program offered on a “first-come, first-served” basis. It also creates a $10 million grant program that would issue a grant for the same amounts. Both programs have a “review trigger” that the legislature will review in 2026. The legislation in total would take $50 million from the state's General Fund account to fund this service.

ISBA is opposed to this legislation because it takes public, taxpayer dollars and provides a refundable tax credit to parents who are already paying for private school tuition – without any accountability, transparency, or requirement that schools accept all children. In each and every state that has adopted a school choice tax credit or education savings account, these programs grow in government spending by more than 50% in their first few years. To read about ISBA's resolution on this topic, click here.

Click here to send a message to your representatives today, and ask them to vote no on HB447. |

|

|

|

House Joint Resolution 1

HJR001 was heard in House State Affairs on Tuesday. This legislation would remove Article 5, Section IX of the Idaho Constitution. ISBA's Immediate Past President Nancy Gregory was there to testify against the bill. After testimony and debate, HJR001 was held in committee at the call of the chair. |

|

|

|

HB415 - The Guns in Schools Bill |

|

|

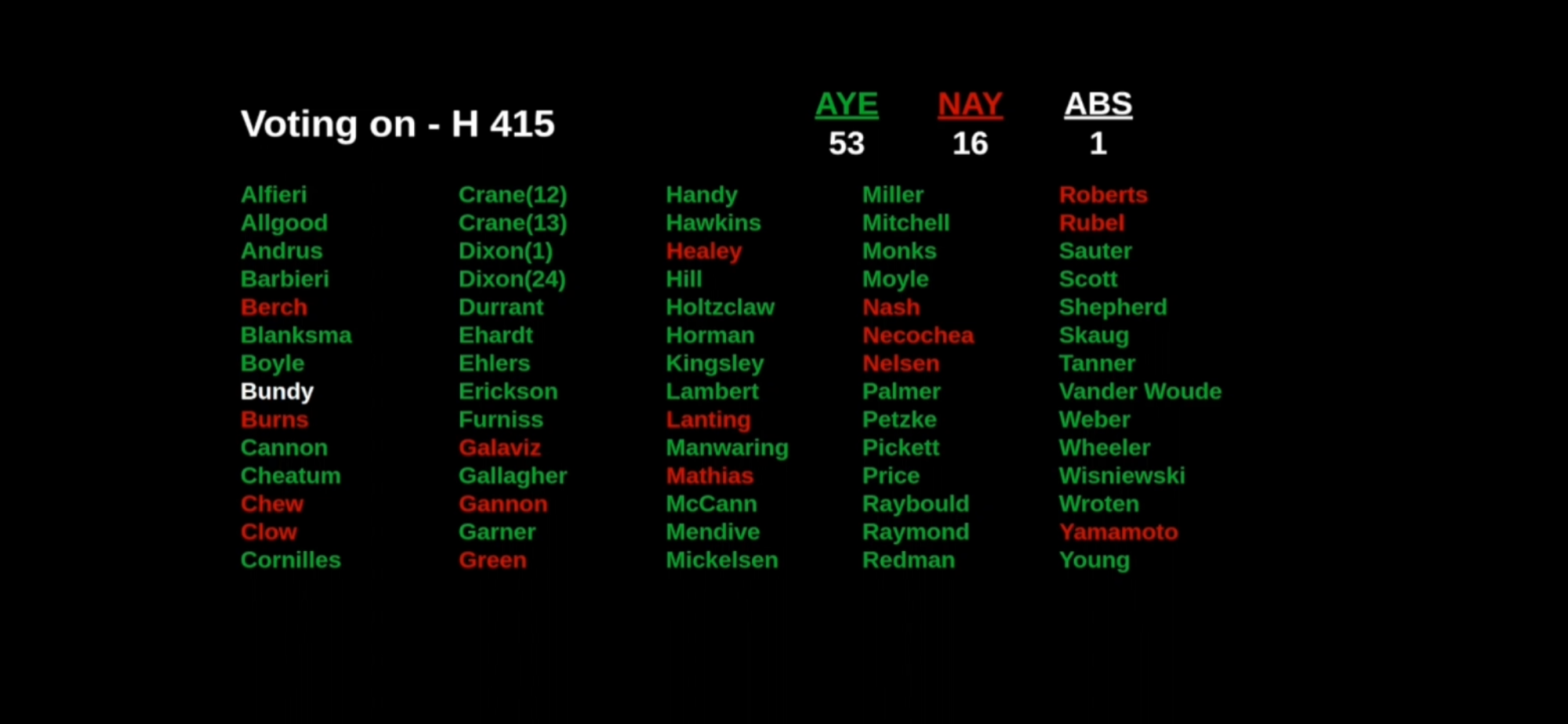

HB415, the bill commonly known as the "guns in schools bill," passed the House Floor on Wednesday with at 53-16 vote. The bill will now move to the Senate side of the Capitol, where it will first be heard in Senate State Affairs. You can keep up with the Senate State Affairs Committee agenda here. On Thursday, opposition to the bill was voiced by the Idaho Sheriff's Association, and the Idaho Association of School Resource Officers has similarly expressed their stance against it.

Contact your senator today, and ask them to vote NO on HB415. |

|

ISBA's opposition to this bill comes from the guiding principles our Executive Board adopted for our advocacy work in 2024, specific to this topic is point two (2) which focuses on local control. You can find those guiding principles here.

|

|

|

|

ISBA Bill Tracker |

|

ISBA is currently tracking 17 bills impacting Idaho public education. The complete bill tracker includes detailed information and ISBA staff analysis regarding the bills. Bill topics include:

|

|

|

|

In the News |

|

|

|

How to Keep Up |

|

You can find committee agendas, reading calendars, legislator information, and more by visiting the Idaho State Legislature website.

You can find live video coverage and footage of the 2023 Legislative Session by visiting the Idaho Public Television - Idaho in Session site.

To view editions of ISBA's 2024 Capitol Notes, click here. |

|

|

|

Who is representing ISBA at the Capitol? |

|

|

Misty Swanson Executive Director |

|

|

Quinn Perry Deputy Director & Government Affairs |

|

|

Katie Russell Communications & Program Associate |

|

|

|

|

199 N. Capitol Blvd. Suite 503 Boise, ID 83702 (866) 799-4722 |